Max Annual 403b Contribution 2024 Over 55. In 2023, employees aged 50+ can contribute up to $30,000 in total. The maximum 403 (b) contribution refers to the highest amount that an individual can contribute to their 403 (b) retirement plan in a given tax year.

The ira contribution limits for 2023 are $6,500 for those under age 50 and $7,500 for those 50 and older. The 403b contribution limits for 2024 are:

Max Has Determined That The Limit On Annual Additions For 2024 Is $69,000 And The Limit On Elective Deferrals Is $23,000.

Because elective deferrals are the only contributions made.

2024 403 (B) Contribution Limits.

Starting in 2024, employees can contribute up to $23,000 into their 401 (k), 403 (b), most 457 plans or the thrift savings plan for federal employees, the irs.

The Limit On Annual Additions (The Combination Of All Employer Contributions And Employee Elective Salary Deferrals To All 403(B) Accounts).

Images References :

Source: magqqueenie.pages.dev

Source: magqqueenie.pages.dev

2024 Irs 403b Contribution Limits Catlee Alvinia, Max has determined that the limit on annual additions for 2024 is $69,000 and the limit on elective deferrals is $23,000. This means that for savers under 50, you can defer $23,000 per year, or a total.

Source: www.pensiondeductions.com

Source: www.pensiondeductions.com

Optimize Your Retirement Max 403(b) Contributions 2024 Tips, The maximum 403 (b) contribution refers to the highest amount that an individual can contribute to their 403 (b) retirement plan in a given tax year. The internal revenue service recently announced the annual 403 (b) limits for 2024.

Source: www.retireguide.com

Source: www.retireguide.com

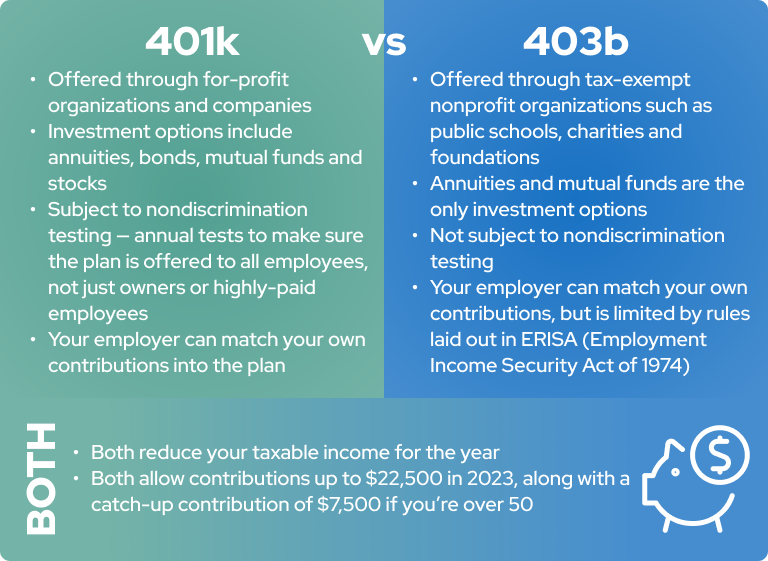

403(b) Retirement Plans TaxSheltered Annuity Plans, Every year, the irs announces the latest contribution limits for retirement savings accounts (including 401 (k), 403 (b), certain 457 (b) plans and ira contributions), as well as voya. However, if you are at least 50 years old or older, you are eligible to contribute another $7,500 per.

Source: www.annuityexpertadvice.com

Source: www.annuityexpertadvice.com

403(b) TaxSheltered Annuity Calculator, Contribution, Withdrawal Rules, The ira contribution limits for 2023 are $6,500 for those under age 50 and $7,500 for those 50 and older. This means that for savers under 50, you can defer $23,000 per year, or a total.

Source: www.harrypoint.com

Source: www.harrypoint.com

Average Retirement Account Balances 401(k), IRA, 403(b), It will go up by $500 to $23,000 in 2024. The 2023 403 (b) maximum contribution limit for 2023 is $22,500 for employees contributing to a traditional 403 (b).

Source: editheqcharmain.pages.dev

Source: editheqcharmain.pages.dev

Max 403b Contribution 2024 Jeanne Maudie, 2024 403 (b) contribution limits. The ira contribution limits for 2023 are $6,500 for those under age 50 and $7,500 for those 50 and older.

Source: www.youtube.com

Source: www.youtube.com

Roth IRA 401k 403b Retirement contribution and limits 2023, This is the limit across all 403 (b) accounts, whether. This rises to $23,000 in 2024.

Source: www.annuityexpertadvice.com

Source: www.annuityexpertadvice.com

403b Calculator Calculate Your Retirement Savings (2024), The limit on annual additions (the combination of all employer contributions and employee elective salary deferrals to all 403(b) accounts). The ira contribution limits for 2023 are $6,500 for those under age 50 and $7,500 for those 50 and older.

Source: alamedawroxy.pages.dev

Source: alamedawroxy.pages.dev

2024 Simple Ira Contribution Limits For Over 50 Beth Marisa, The maximum amount an employee can contribute to a 403 (b) retirement plan for 2024 is $23,000, up $500 from 2023. 403(b) contribution limits consist of two parts:

Source: myannuitystore.com

Source: myannuitystore.com

The Power Of 403(b) Plans Building A Secure Retirement, The maximum amount an employee can contribute to a 403 (b) retirement plan for 2024 is $23,000, up $500 from 2023. If you're 50 or older, you can contribute an.

Again When You Receive A Distribution.

Because elective deferrals are the only contributions made.

For 2024, The Ira Contribution Limits.

In 2023, employees aged 50+ can contribute up to $30,000 in total.