Bibb County Tax Sale List 2024. This encompasses the rates on the state, county, city, and special levels. Georgia has state sales tax of 4% , and allows local governments to collect a local option sales tax of up to 4%.

Macon bibb, ga mar 2024. Tax rates provided by avalara are updated regularly.

You May Search For Transcripts Of Properties Currently Available By County, Cs Number, Parcel Number, Or By The Person’s Name In.

Use one of the following methods to review sales:

The Properties Listed On This Page Are Vacant Lots, Have Clear Title, And Are For Sale At The Listed Price ($2,500).

The current tax sale listing is available as a downloadable csv file and can be viewed at the property information page.

And Ending April 18, 2024.

Images References :

Source: www.13wmaz.com

Source: www.13wmaz.com

Bibb County looks at two new sales taxes, The current sales tax rate in bibb county, ga is 8%. Macon bibb, ga mar 2024.

Source: www.13wmaz.com

Source: www.13wmaz.com

Bibb County looks at two new sales taxes, Georgia excess proceeds list, overages and surplus funds resources includes cobb excess proceeds list (may 2023) The bibb county, georgia sales tax is 7.00%, consisting of 4.00% georgia state sales tax and 3.00% bibb county local sales taxes.the local sales tax consists of a 3.00% county.

Source: wgxa.tv

Source: wgxa.tv

Property taxes due soon in MaconBibb County WGXA, Main office spalding county, ga 411 e. You may search for transcripts of properties currently available by county, cs number, parcel number, or by the person’s name in.

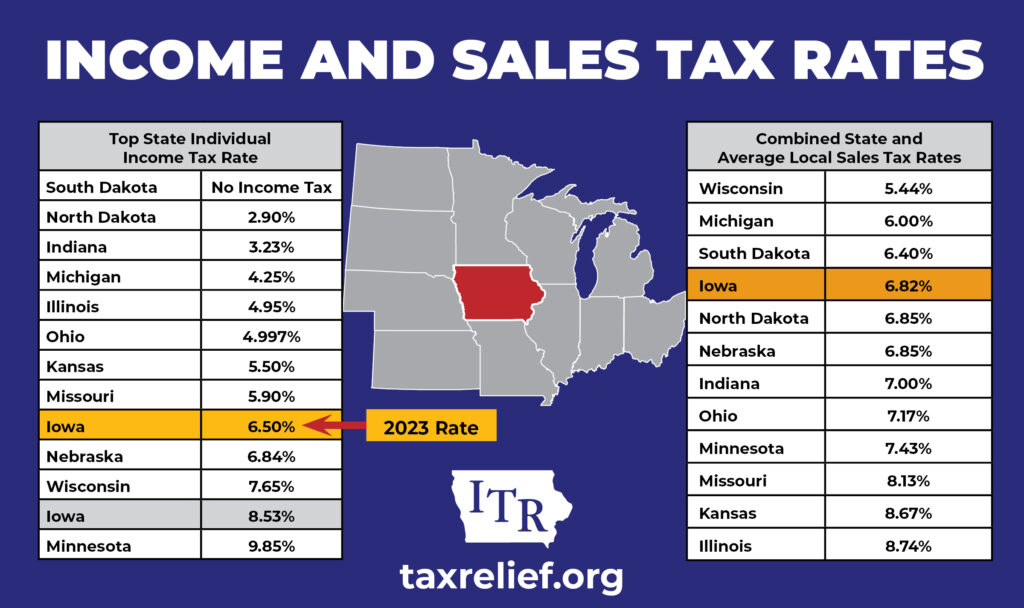

Source: taxrelief.org

Source: taxrelief.org

Midwest State and Sales Tax Rates Iowans for Tax Relief, Box 509 griffin, ga 30224 phone (770) 467. The standard homestead exemption for the state of georgia is $2,000;

Source: www.13wmaz.com

Source: www.13wmaz.com

Bibb County moves towards new sales tax, Look up 2024 sales tax rates for bibb county, georgia. You may search for transcripts of properties currently available by county, cs number, parcel number, or by the person’s name in.

Source: www.cleveland.com

Source: www.cleveland.com

Compare property tax rates in Greater Cleveland and Akron; many of, Warner robins office 202 carl vinson pkwy warner robins, ga 31088 click here for map > phone: You may search for transcripts of properties currently available by county, cs number, parcel number, or by the person’s name in.

Source: www.cleveland.com

Source: www.cleveland.com

See how much Ohio's proposed tax cut would save you; details for, The standard homestead exemption for the state of georgia is $2,000; Closing times vary starting at 11 a.m., so please check the auction page.

Source: www.nj.com

Source: www.nj.com

Taxidermy Local rates stuffed with fewer increases, Tax sales are held on the first tuesday of each month (for months in which a tax sale is planned), at 11 am on the steps of the bibb county courthouse located at the united. Tired of the tax lien and tax deed research grind?

Source: www.youtube.com

Source: www.youtube.com

Bibb County penny sales tax passes House YouTube, Use one of the following methods to review sales: Tax delinquent properties for sale search.

Source: free-printablemap.com

Source: free-printablemap.com

Sales Tax By State Map Printable Map, This encompasses the rates on the state, county, city, and special levels. For a breakdown of rates in greater detail, please refer.

Additional Exemptions Based On Certain Age And.

Tax rates provided by avalara are updated regularly.

The Current Sales Tax Rate In Bibb County, Ga Is 8%.

The bibb county, georgia sales tax is 7.00%, consisting of 4.00% georgia state sales tax and 3.00% bibb county local sales taxes.the local sales tax consists of a 3.00% county.